Broker claims made easy

A no-code claims platform that adapts as your business grows. Purpose built for brokers in AU/NZ.

Book a demoOne streamlined process to manage claims across all your insurers.

-

Instant visibility

See every claim in one platform, across all insurers, with full history, documents, and real-time updates.

-

Seamless handovers

Staff changes, sick days, or surges won't stall claims. Anyone can step in with full context.

-

Compliance built-in

Prevents GICOP breaches by tracking timelines and prompting staff to update clients.

Broker-first system

A single shared workspace to coordinate claims across insurers, keep clients happy, and free up time for growing the book.

Book a demo

Smart lodgement tool for brokers

- One consistent claims process

- From 50+ insurer forms to one, branded for your business.

- Capture the right details upfront

- Forms adapt by insurer and product so claims are lodged correctly the first time. No more chasing customers for missing information.

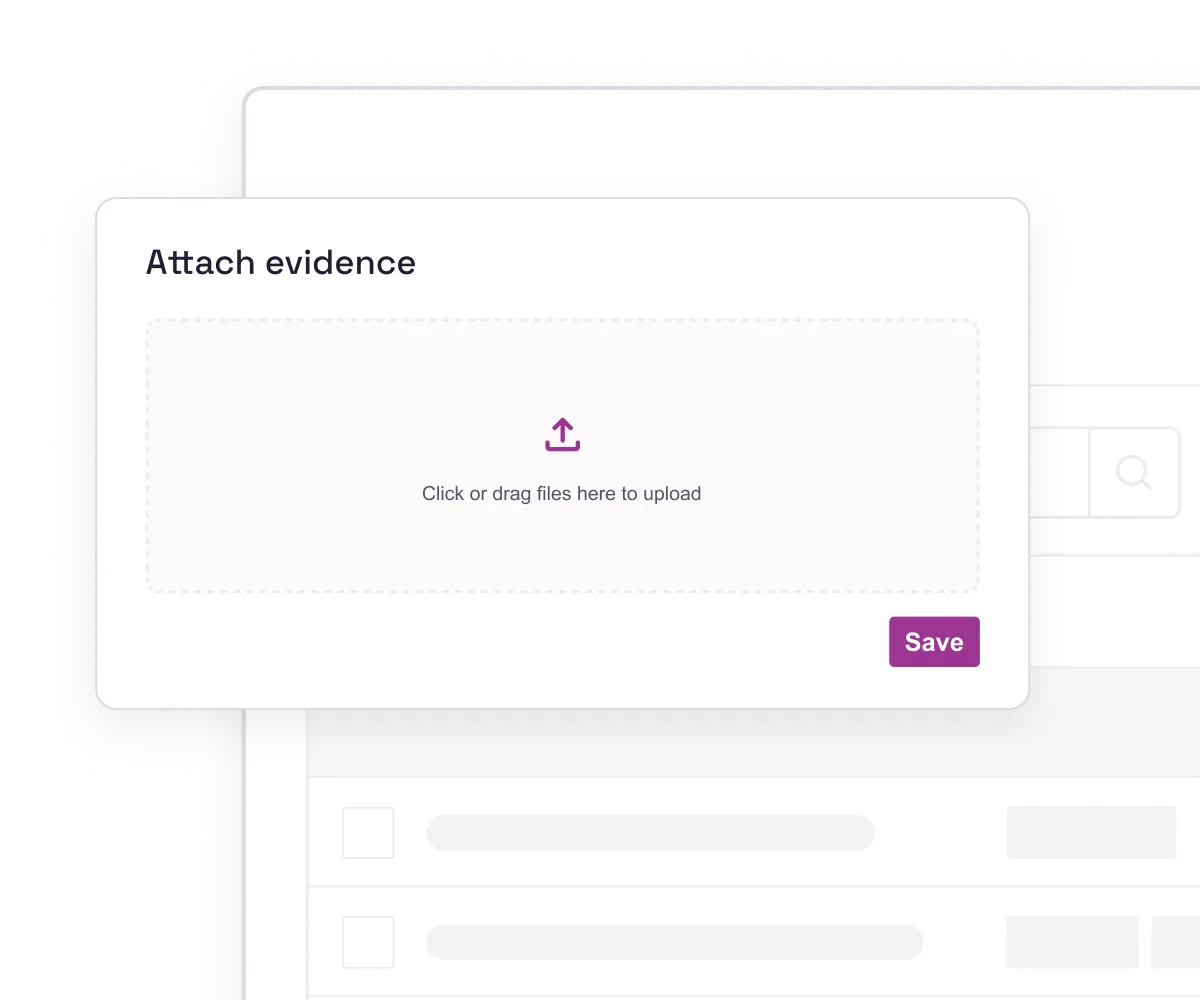

- One trackable workspace

- Every claim flows into one workspace. No more switching between forms or portals.

Our claims lodgement tool is available as a standalone product for brokers.

- Integrate with claim systems like Wilbur and Duck Creek.

- Clients can lodge easily from any device.

- Save time on admin with full compliance records from day one.

One shared workspace

- All stakeholders aligned

- Brokers, insurers, agencies, and suppliers all working together from the same live record. Cut duplication and rework.

- Complete claims visibility

- Every email, document and note logged automatically with timestamps and full history.

- Prove compliance with ease

- Code timelines tracked are automatically ready for insurers and regulators.

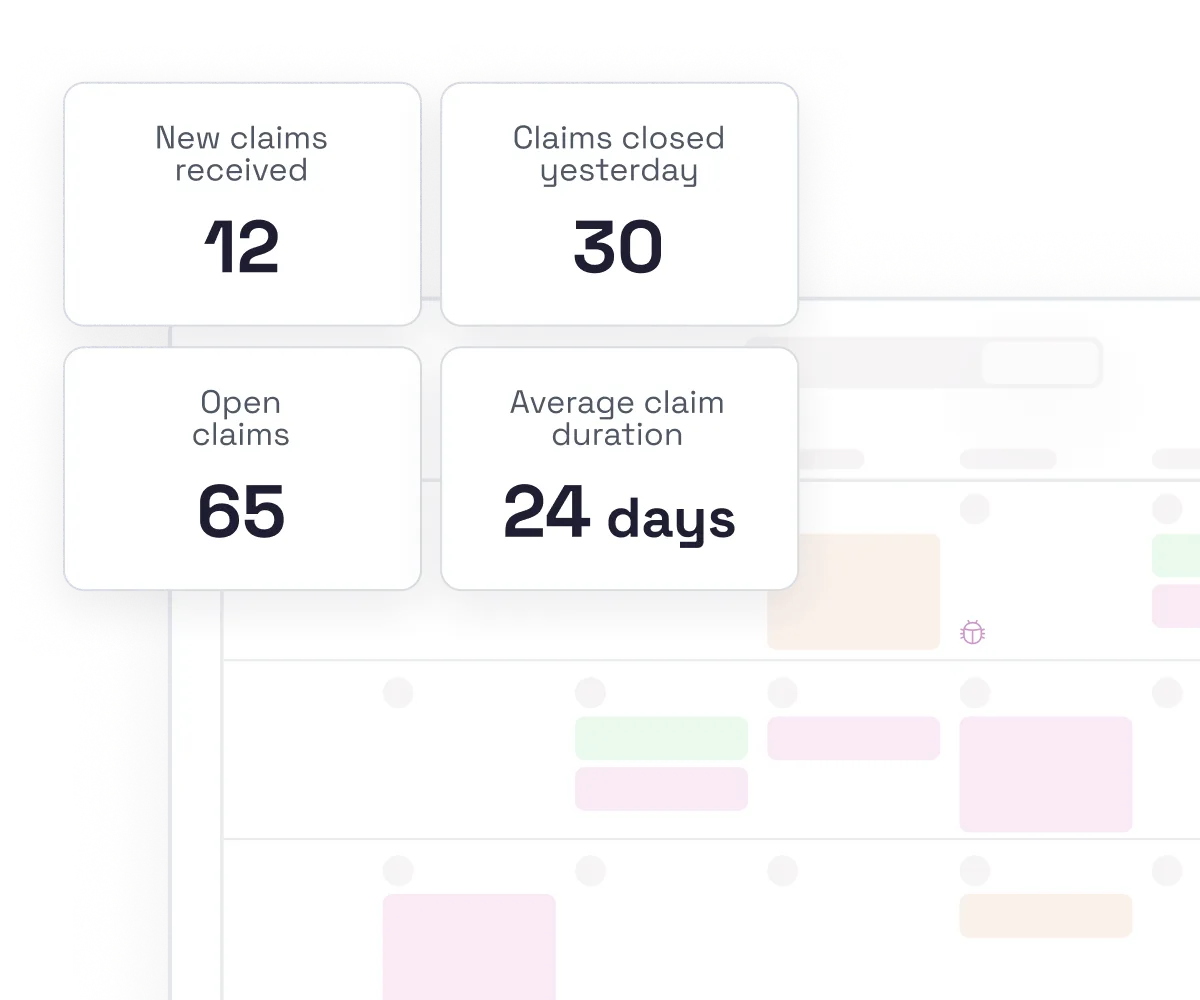

A clear view for leaders

- Real-time dashboards

- Live visibility across every claim - volumes, progress, and team workload.

- Prevent issues before they happen

- Tasks automatically escalate as deadlines approach, prompting action before breaches occur.

- Audit-ready in 1-click

- ASIC, AFCA, and insurer reports generated without the spreadsheet grind.

Adapts with your brokerage

Update processes in minutes, not months. No IT required.

-

Quick setup

No developers or consultants required. Save on IT costs.

-

Configure as you go

Update forms, workflows, and rules yourself, so you can keep up with new products and regulations.

-

Built for change

Future-proof operations. Stay compliant and competitive as business and regulations evolve.

Get started with Curium

-

Step 01: Understand your business

We review your current claims process and pain points.

-

Step 02: Set up your platform

We configure Curium to match how your brokerage works.

-

Step 03: Platform training & support

Quick training to get your team started. Ongoing support whenever you need it.

Your questions, answered.

Commonly asked questions about Curium's Claims Platform for Brokers.

- Curium centralises every claim in one place. No more chasing emails, calling insurers for updates, or switching between portals. You get live claim status, complete communication history, and all documents in a single workspace, helping your brokerage handle claims faster and more efficiently.

Simplify claims management

Start with a free assessment of your processes. Based on this, we'll create a personalised demo to show you how Curium can help your business.

Book a demo