Enterprise-level claims made simple

Adaptable, no-code claims platform for insurers and agencies.

Book a demoTurn claims into your competitive advantage.

-

Settle fast

Fast, accurate lodgement with AI triage that keeps claims moving – all in one shared workspace.

-

Reduce leakage

Automated safeguards and structured workflows catch errors early and reduce hidden losses.

-

Stay compliant

Track ASIC, GICOP, and other code obligations in real time. Reports ready in one click.

End-to-end claims management

Handle every step of your insurance claim lifecycle in one platform – from lodgement, to decision, to recovery.

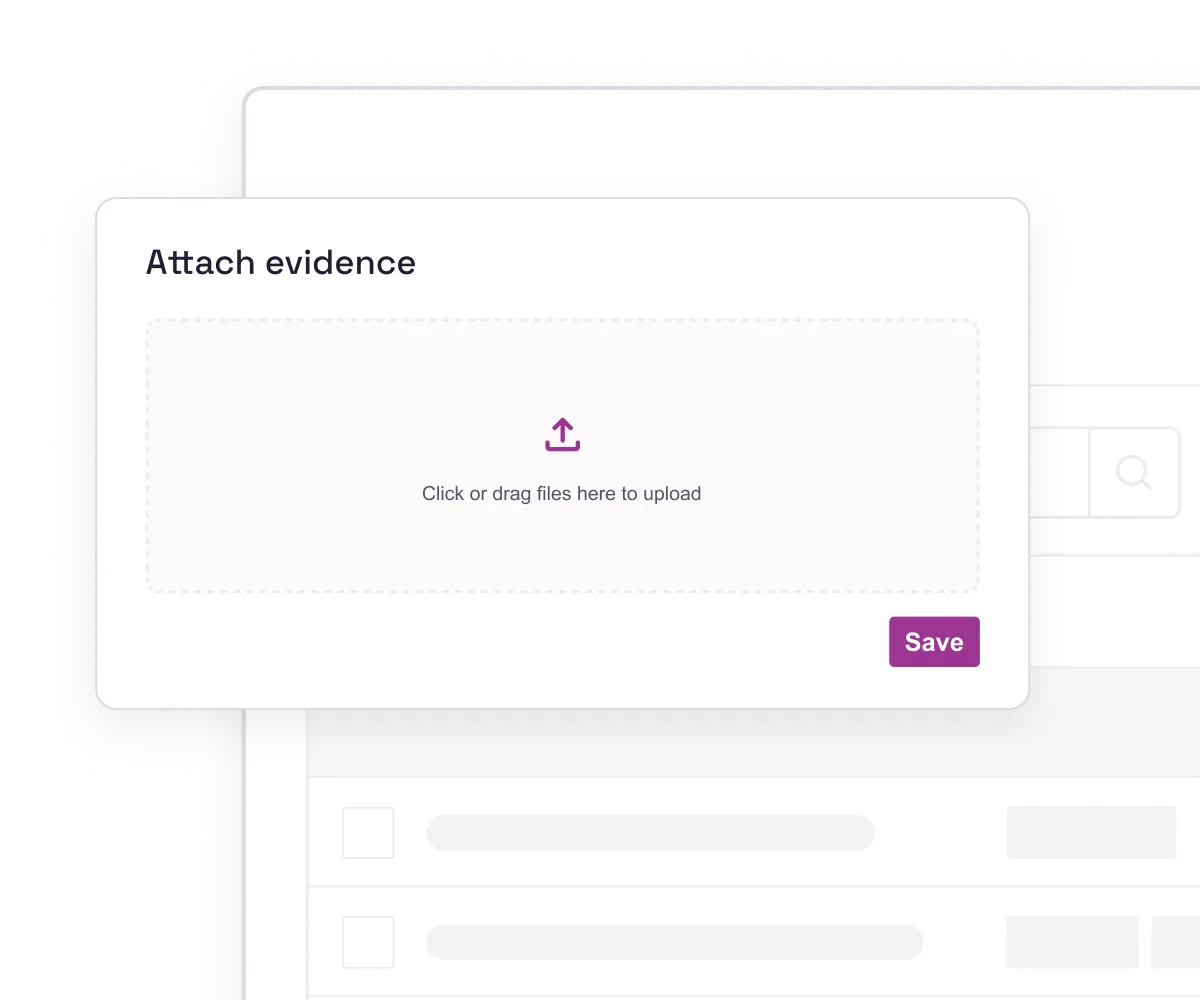

Lodge right the first time

Capture everything upfront with smart forms – including data, documents, photos, and recovery triggers.

- Reach triage faster when every claim arrives with the information you need.

- Straightforward claims settle automatically, so your team can focus on complex cases.

- Stop leakage early with real-time reporting and faster decision-making.

Make faster decisions

Route urgent claims instantly and make consistent, defensible decisions – before small issues turn into big losses.

- AI assigns priority, SLA and team routing the moment a claim arrives.

- Apply coverage the same way every time with guided checklists and exclusions.

- Supplier reports feed straight into the claim with geo and timestamps.

Keep payments under control

Reduce leakage and surprises. Keep reserves accurate and payments compliant.

- Flag payments above authority limits and prompt reserve reviews at the right stages.

- Track payments by category to spot leakage and keep reserves accurate.

- Automatic GST reporting and calculations on payments and recoveries.

Close claims with confidence

Resolve every claim on time, fairly, and fully compliant.

- Automated workflows prompt the next action, flag delays, and keep everyone aligned.

- Track supplier performance at claim level to meet CPS 230 requirements.

- Keep customers updated with automated deadlines and milestone prompts – reducing inbound calls.

Improve recovery rates

Recover more by acting earlier and protect your loss ratio.

- Built-in rules flag recovery opportunities and prompts to capture evidence early.

- Early evidence means faster action, better recovery rates, and less leakage.

- Never miss a limitation date — they’re tracked automatically, so nothing slips through.

Claims lodgement tool

Our claims lodgement tool is also available as a standalone product for insurers and agencies.

- Integrate with claim systems like Wilbur and Duck Creek.

- Customers can lodge claims easily from any device via fully branded forms.

- Reduce leakage, delays and admin with accurate lodgement.

Curium cuts complexity & time

What used to take hours now takes minutes. No more stitching tools together or guessing what’s required.

Book a demo

- 30% faster

Claims intake

Complete claims from day one with smart digital forms that capture data, documents, and photos upfront.

- 10+ hours

Saved on ASIC & CGC reporting

One-click reporting pulls the data you need instantly. No chasing information across systems.

- 1 digital form

To replace 6-page claims forms

Simpler for clients to lodge. Faster for your team to process.

Simple to start & scale

Enterprise capability without the complexity.

-

Easy platform changes

Update workflows and rules instantly yourself as your business changes.

-

One shared workspace

Full visibility and alignment for all stakeholders - claims teams, suppliers and underwriters.

-

See the full picture

Clear view for managers to track leakage, reserves, and bottlenecks in real time, even when volumes spike.

Get started with Curium

-

Step 01: Understand your process

We review your products, policies, and claims bottlenecks.

-

Step 02: Set up your platform

We configure Curium to match how your business works.

-

Step 03: Platform training & support

Quick training to get your team started. Ongoing support whenever you need it.

Your questions, answered.

Commonly asked questions about Curium’s Claims Platform for Agencies & Insurers.

- Curium is flexible claims software used by insurers, agencies, and authorised reps. It can be used to manage claims for the full spectrum of insurance products – motor, property, liability, business, pet, travel, and more. Whether it's high-volume simple claims or complex, multi-party cases, Curium provides one platform for the entire process.

Simplify claims management

Start with a free assessment of your processes. Based on this, we’ll create a personalised demo to show you how Curium can help your business.

Book a demo